Think You Know It All? How Overconfidence Can Break Your Budget

Overconfidence can sabotage your budget. Learn to spot the signs, break the cycle, and build financial resilience with this guide to managing personal finances effectively.

Starting next month, I’ll save,” “I can handle a little more debt,” or “I always manage to land a job.” These thoughts might sound familiar. Self-confidence is often celebrated as a strength—it propels us forward, helps us face challenges, and fosters a positive outlook. However, when it comes to personal finances, this same confidence can morph into overconfidence, a cognitive bias that may lead to risky financial decisions. Let’s explore how overconfidence impacts your budget and what you can do to avoid its pitfalls.

What is Overconfidence Bias?

Overconfidence bias is the tendency to overestimate our abilities, making us overly optimistic about outcomes. While a healthy sense of confidence can motivate action, excessive confidence can cloud judgment and lead to missteps in financial planning.

Signs You Might Be Overconfident

- Impulsive Spending: “I deserve this, and I’ll figure out how to pay later.”

- Underestimating Debt: Assuming you can handle more debt without repercussions.

- Ignoring Financial Tools: Skipping budgets or refusing financial advice.

- Assuming Future Success: Believing financial wins will come without preparation.

The Cost of Overconfidence

When overconfidence guides financial decisions, the consequences can include accumulating debt, stagnating savings, and missing opportunities for growth. Let’s delve into some specific behaviors:

1. Overspending

Feeling invincible can lead to spending beyond your means. The assumption that you’ll always recover financially fuels this cycle.

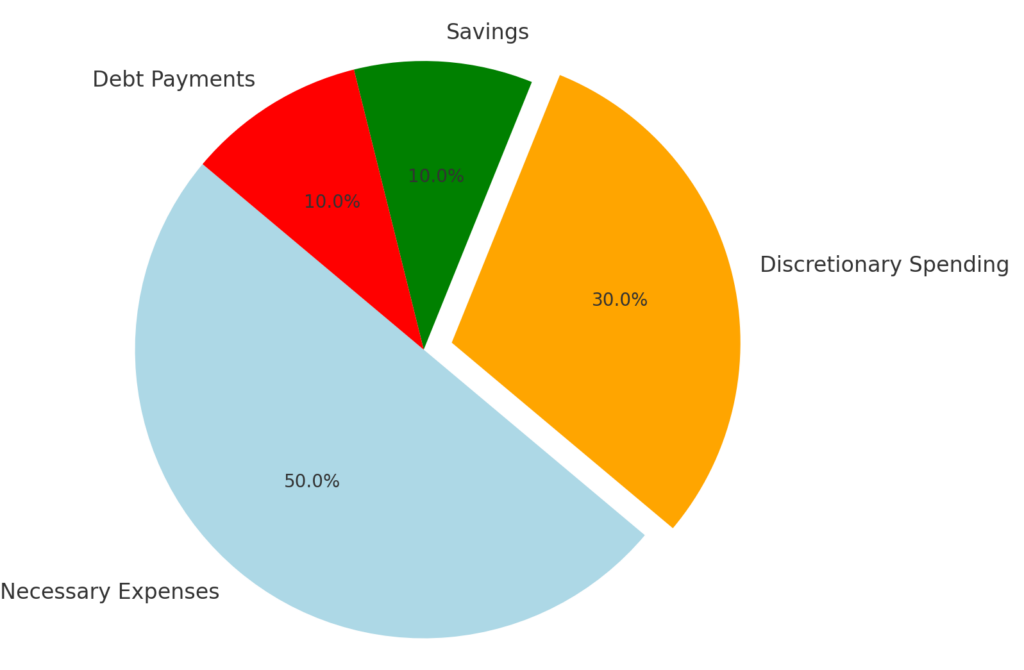

Graph 1: Overspending Cycle

2. Ignoring Budgets

Overconfident individuals may skip budgeting, believing they’re naturally in control. Yet, a budget is crucial for identifying areas to cut back and save.

Table: Benefits of Budgeting

| Budget Benefits | Result |

|---|---|

| Tracks Expenses | Identifies excess |

| Plans Savings Goals | Builds a safety net |

| Manages Debt | Avoids financial stress |

3. Neglecting Bank Statements

By avoiding regular statement reviews, you may lose sight of spending patterns, leading to unchecked financial issues.

How to Break the Overconfidence Trap

1. Embrace Realism

Conduct an honest self-assessment. Identify strengths and weaknesses in your financial habits and acknowledge areas needing improvement.

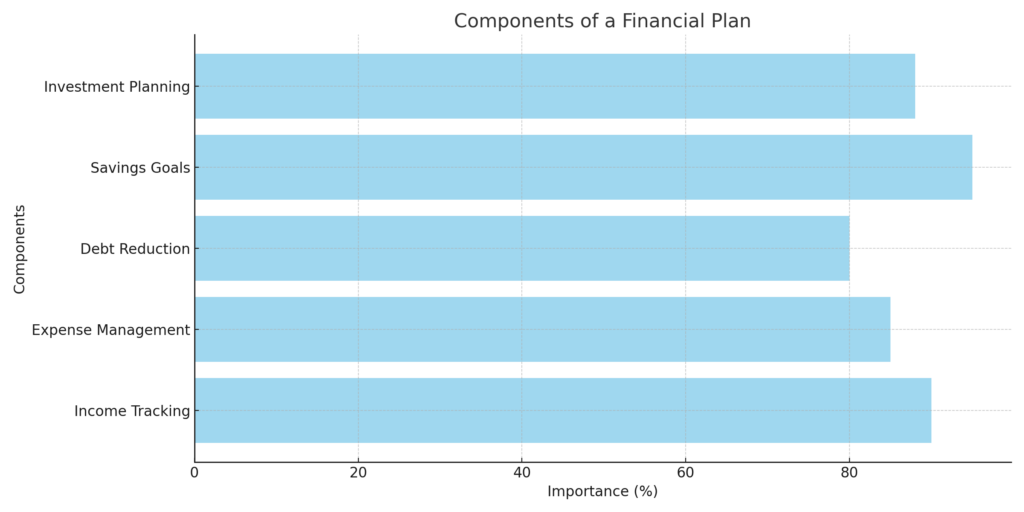

2. Create a Financial Plan

A clear, actionable plan can prevent impulsive decisions. Outline goals, track progress, and adjust as needed.

Graphic 2: Components of a Financial Plan

3. Seek Financial Advice

Overcoming overconfidence means learning from others. Consider consulting a financial advisor or joining online finance communities for fresh insights.

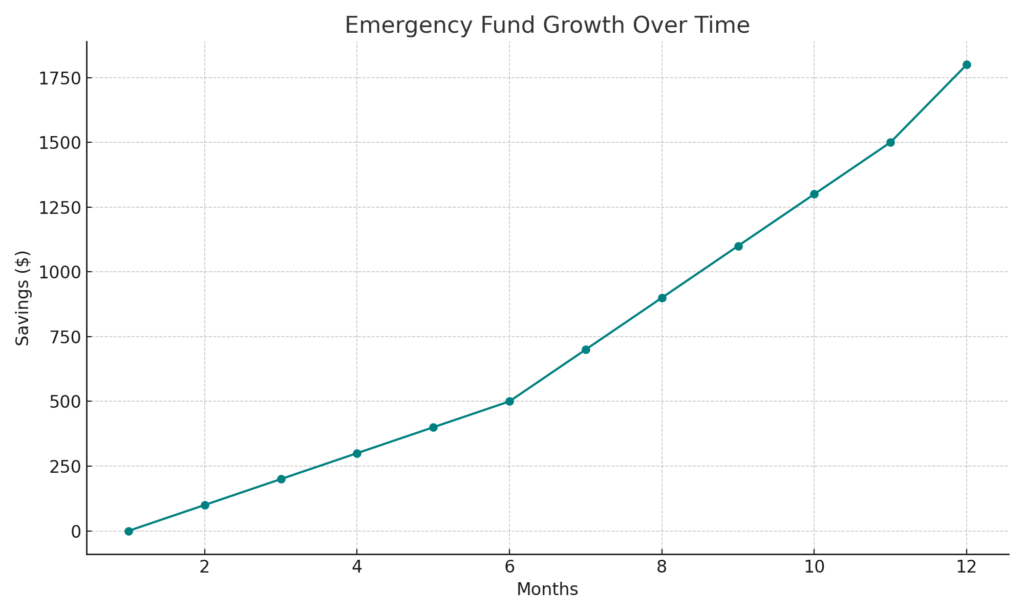

4. Build Resilience

Financial resilience ensures stability even during unexpected challenges. Key steps include:

- Emergency Fund: Save 3–6 months’ worth of living expenses.

- Diversify Income: Explore freelance work or investments to reduce reliance on a single income stream.

Graph 3: Emergency Fund Growth Over Time

Balance Confidence with Caution

Confidence is a strength, but overconfidence can become a financial liability. By pairing optimism with careful planning, ongoing learning, and humility, you can safeguard your financial future.

Ready to boost your financial resilience and take control of your budget? Start by creating a realistic financial plan today!

Want more actionable advice? Check out our A Practical Guide to Mastering Financial Organization and Boosting Money Management for practical tips to optimize your financial habits and achieve long-term goals.