How to Build Your Credit History from Scratch: A Complete Guide for Young People

Learn how to build your credit history from scratch with this comprehensive guide. Discover actionable steps, from opening your first bank account to managing credit cards responsibly, and set yourself up for long-term financial success.

Entering adulthood often means managing your finances independently for the first time. Establishing a credit history is one of the most critical steps in this journey. A solid credit profile doesn’t just help you secure loans; it’s essential for achieving life goals like renting an apartment, purchasing a car, or even financing education. If you’re looking to start building your credit history, you’re in the right place! Let’s explore what credit history is, why it’s essential, and how you can create it from scratch.

What is Credit History?

At its core, credit history is a record of your borrowing and repayment behavior over time. It reflects how much debt you have, how promptly you make payments, and whether you’ve defaulted on any loans. Financial institutions use this data to assess your creditworthiness.

Key Points About Credit History:

- What It Includes: Loan amounts, repayment timelines, and any defaults.

- Why It Matters: It impacts loan approvals, interest rates, and even rental or job applications.

- How It’s Measured: Through credit scores that range from poor to excellent based on your financial behavior.

Why is Credit History Important?

A strong credit history is your financial resume. It influences:

- Loan Approvals: Lenders check your credit report to gauge reliability.

- Interest Rates: A good credit score can secure lower interest rates.

- Life Opportunities: Some employers and landlords review credit reports for insight into your responsibility.

Tip: Start early to establish a positive record. A small financial step today can lead to significant savings tomorrow.

How to Build Your Credit History from Scratch

1. Enter the Financial System

To start, you need to establish your presence in the financial system.

Steps to Begin:

- Open a Transactional Account: Deposit income and pay bills to build transaction history.

- Open a Savings Account: Cultivate a habit of saving and earn interest.

Table 1: Benefits of Different Account Types

| Account Type | Purpose | Benefits |

|---|---|---|

| Transactional Account | Day-to-day transactions | Builds transaction history |

| Savings Account | Long-term saving | Earns interest, shows planning |

2. Apply for Your First Credit Card

A credit card is a powerful tool for building credit if used wisely.

Why Get a Credit Card?

- Build Credit: Timely payments enhance your score.

- Practice Debt Management: Learn to handle financial obligations responsibly.

Checklist Before Applying:

- Understand fees, limits, and payment terms.

- Learn how to read statements and manage due dates.

3. Use Your Credit Card Responsibly

Strategies for Success:

- Set a Budget: Only charge what you can pay in full each month.

- Prioritize Large Purchases: Use for tuition or electronics to show responsible management.

- Pay on Time: Always meet your deadlines to avoid penalties.

4. Utilize Store Credit

Retail stores often offer installment credit options. This can help you build a credit history while making necessary purchases.

How to Start:

- Choose a frequently visited store.

- Understand payment terms before signing up.

5. Put a Service Bill in Your Name

Utility bills (e.g., electricity, internet) in your name can demonstrate financial responsibility.

Steps:

- Select a manageable service.

- Use automatic payments to avoid missed due dates.

Strategies to Grow Your Credit History

1. Improve Financial Literacy

Understanding credit is critical. Resources like online courses, books, and blogs can enhance your knowledge.

2. Take a Loan

After managing small debts, consider applying for a personal loan. This could fund significant goals, like education or buying a car.

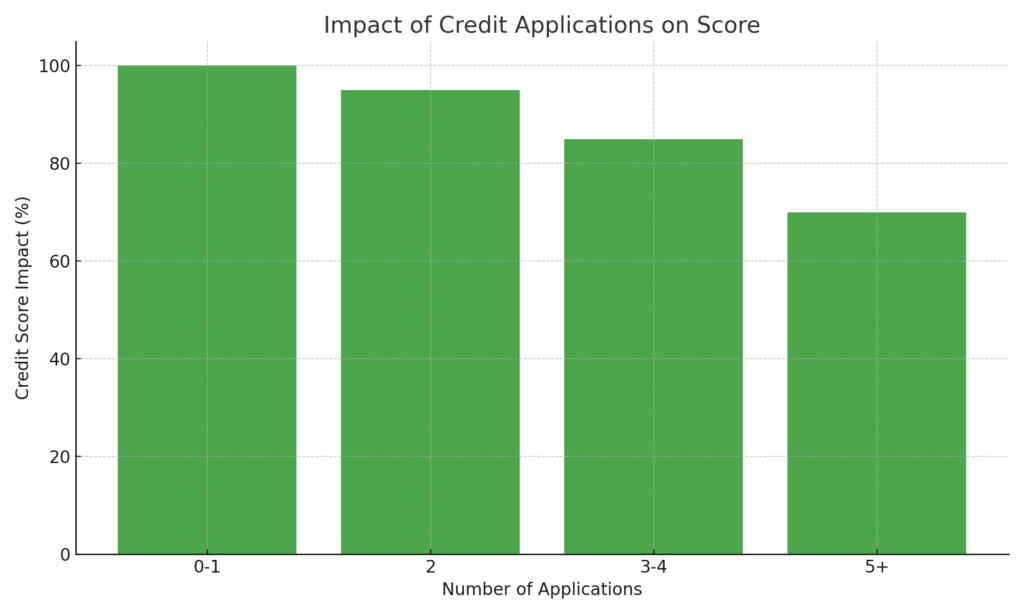

3. Avoid Frequent Credit Applications

Multiple applications can lower your score. Instead:

- Apply strategically.

- Address rejections by asking for feedback.

Infographic 1: Credit Application Impact on Score

Maintaining Good Credit

1. Regularly Check Your Credit Report

Monitor your credit report for errors. Many bureaus offer free annual access.

2. Diversify Credit Types

Lenders prefer a mix of accounts (credit cards, loans). However, only open accounts you can manage responsibly.

3. Use Credit Sparingly

Keep your credit utilization ratio below 30%. This means not using more than 30% of your credit limit.

4. Automate Payments

Set up automatic payments to avoid missing deadlines.

Final Thoughts

Building a credit history requires time, discipline, and consistent effort. Here’s a quick recap:

- Start Early: Open accounts and apply for credit responsibly.

- Stay Educated: Learn about financial management tools.

- Track Progress: Regularly review your credit report.

With these steps, you’re not just building credit—you’re creating a foundation for a secure financial future. Stay patient and proactive, and your efforts will pay off.